For a long time, Noida was seen as NCR’s “next big opportunity”—a market with promise, but not yet parity with Delhi or Gurugram. That phase is now over.

Today, Noida stands at the centre of NCR’s most decisive real estate transformation, powered by large-scale infrastructure delivery, rising institutional participation, and a more predictable policy environment. This growth cycle is fundamentally different from earlier ones. It is not speculative. It is structural.

Infrastructure: The Backbone of Noida’s Real Estate Momentum

Infrastructure has emerged as the single most important force behind Noida’s real estate expansion. Unlike previous cycles where development followed demand, Noida is witnessing infrastructure-first growth—a critical shift that creates long-term stability.

Key Infrastructure Catalysts Driving Growth

-

The Noida–Greater Noida Expressway and Yamuna Expressway enabling seamless regional mobility

-

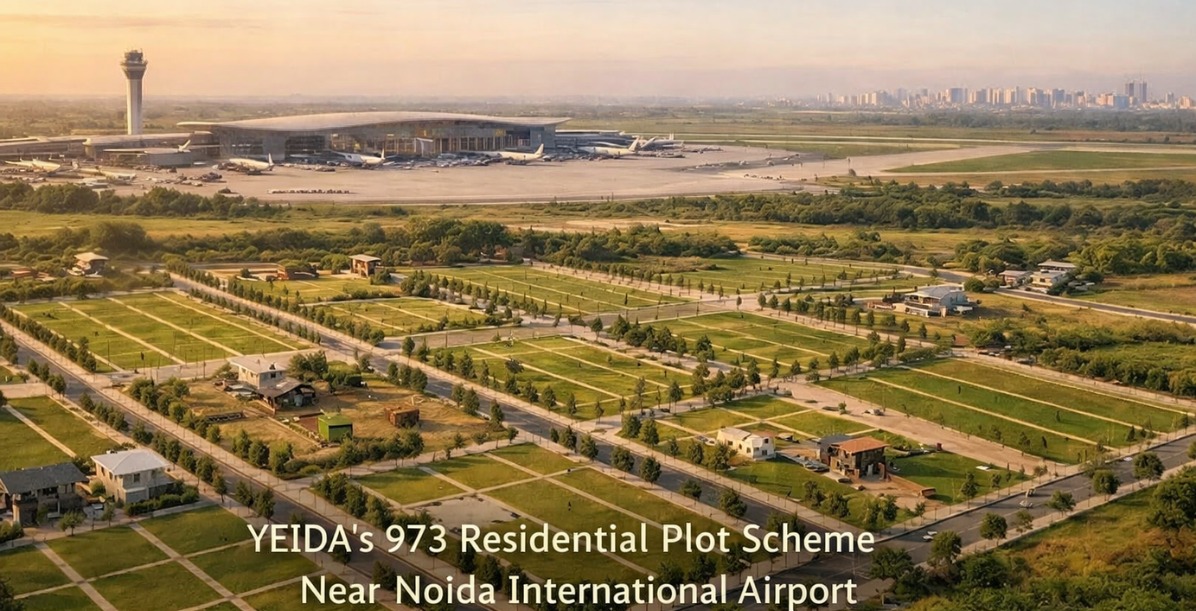

Jewar International Airport (Phase 1), anchoring an aviation-led economic corridor

-

Ongoing metro network expansion improving last-mile and daily commute efficiency

-

Multi-expressway convergence connecting Noida with Delhi, Ghaziabad, Gurugram, and western Uttar Pradesh

This sequencing—where infrastructure leads and real estate follows—is rare in Indian urban development and significantly lowers long-term market risk.

Why Institutional Capital Is Choosing Noida

A defining feature of Noida’s current growth cycle is the rise of institutional capital, not just individual end-users or speculative investors.

Noida now accounts for:

-

A growing share of NCR’s office space absorption

-

Strong inflows from IT, ITES, fintech, electronics manufacturing, and data centers

-

Large, contiguous land parcels enabling campus-style and mixed-use developments

Global occupiers are increasingly choosing Noida not merely for cost advantages, but for:

-

Scalability of development

-

Certainty of infrastructure delivery

-

Clear, long-term policy visibility

As employment clusters expand, residential demand follows naturally—creating a self-reinforcing growth loop.

Noida vs Gurugram: A Shift in Market Fundamentals

While Gurugram remains a premium and mature market, Noida is evolving into a more balanced and opportunity-driven ecosystem.

| Factor | Noida | Gurugram |

|---|---|---|

| Infrastructure trajectory | Rapidly expanding | Largely saturated |

| Land availability | High | Severely constrained |

| Price discovery | Still evolving | Mostly mature |

| Entry opportunity | Strong | Limited |

For investors and long-term buyers, Noida offers something increasingly rare in NCR: visible growth backed by execution, not assumption.

Residential Real Estate: From Affordable to Aspirational

Noida’s residential market has moved well beyond its earlier affordability-driven image. Current demand is being shaped by:

-

Mid-income and premium housing near employment hubs

-

Low-density, large-format projects along expressway corridors

-

End-users prioritising commute certainty, open spaces, and long-term livability

Importantly, price movement today is being driven by:

-

Real absorption rather than booking spikes

-

On-ground infrastructure delivery

-

Better developer discipline and project selection

This marks a shift away from speculative flipping toward end-user-led stability.

Noida Real Estate Outlook: 2026–2035

Over the next decade, Noida is positioned to evolve as:

-

A core employment node within NCR

-

A logistics and aviation-linked growth corridor

-

A residential alternative to the congestion of Delhi and Gurugram

With major infrastructure already under execution and policy momentum intact, Noida’s growth curve appears durable rather than cyclical.

Final Take: Why Noida’s Growth Is Different This Time

Noida’s real estate story today is built on execution, not expectation.

-

Infrastructure is visible on the ground

-

Capital is increasingly institutional

-

Demand is diversified across residential and commercial

-

Growth is aligned with long-term policy planning

For end-users, investors, and planners alike, Noida is no longer a future bet. It is an active, structural growth market—quietly but decisively reshaping NCR’s real estate landscape.

.png)

.png)

.png)