Overview: What Is Being Reported

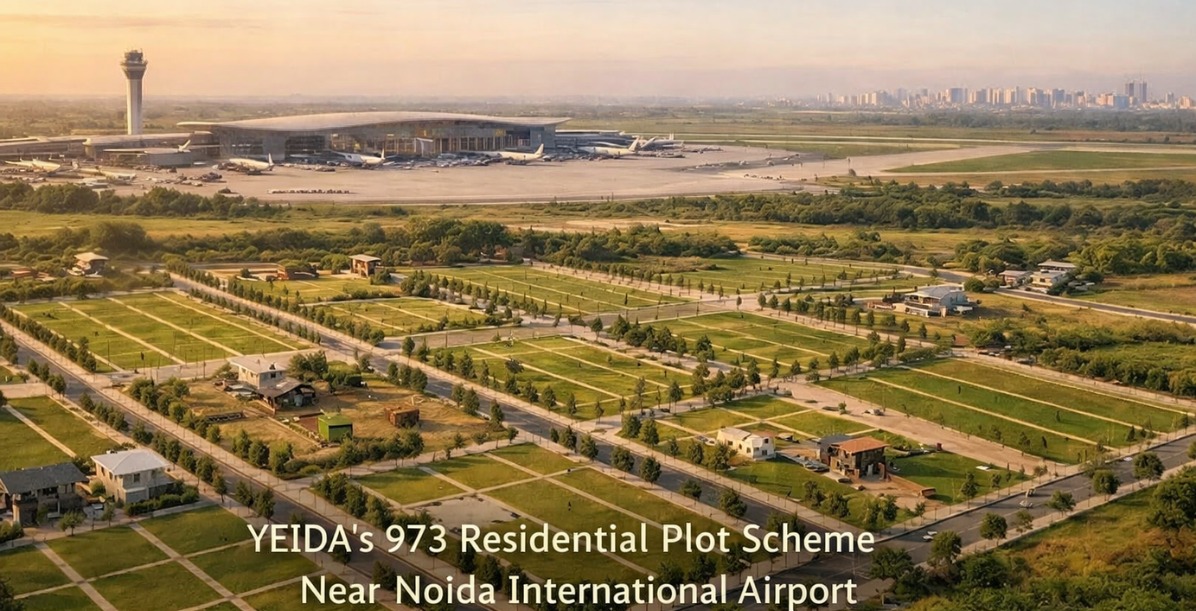

The Yamuna Expressway Industrial Development Authority (YEIDA) has reportedly initiated preparations for a new residential plot scheme comprising 973 plots in the vicinity of the Noida International Airport.

According to multiple media reports, the proposed plots are expected to be located across YEIDA Sectors 15C, 18, and 24A, with a range of plot sizes aimed at different buyer segments.

However, while the announcement has generated strong market attention, several critical elements are still not officially available in the public domain, making verification essential before any buyer commitment.

Key Details Being Reported (As of Now)

Based on publicly available reporting:

Total plots: 973 residential plots

Reported plot sizes: 162 sq m, 183 sq m, 184 sq m, 200 sq m, 223 sq m, and 290 sq m

Sectors mentioned: 15C, 18, and 24A (YEIDA jurisdiction)

Reservation structure (reported):

17.5% for eligible farmers

5% for functional industrial units

77.5% for the general category

Regulatory status: YEIDA officials have stated that UP RERA registration is under process, and the official scheme brochure is being prepared

These points are reported, not yet document-verified.

What Is Still Not Publicly Verifiable

As of now, the following cannot be independently verified from official YEIDA portals:

Final scheme brochure (PDF)

UP RERA registration number

Official sector-wise rates

Confirmed development milestones

Possession or handover timelines

Payment schedule and penalty clauses

Until these are released officially, any pricing, possession year, or “launch date” claims should be treated as indicative—not final.

Timeline Snapshot: Reported vs Confirmed

20 January 2026

National media reports that YEIDA has “announced” a residential plot scheme

Mentions 973 plots, sectors 15C / 18 / 24A

Suggests a near-term launch window

21 January 2026

Additional outlets reiterate plot count and sectors

Some reports introduce price expectations, though these are not supported by an official brochure

Current Status Check

The specific 973-plot scheme does not yet appear in YEIDA’s publicly accessible scheme archive

UP RERA registration details are awaited

Bottom line: Announcement momentum exists, but formal documentation is still pending.

What This Means for Buyers on the Ground

1) This Is Plotted Land—Not Ready Housing

Plots near emerging infrastructure corridors typically attract:

End-users planning to construct homes in phases

Long-term investors with the ability to hold through development cycles

This is not a ready-to-move purchase. Development sequencing, possession clauses, and sector-level infrastructure matter more than launch headlines.

2) Allotment Is Likely Draw-Based

YEIDA’s past residential plot schemes clearly specify draw-based allotment, not first-come-first-serve.

This means:

No guaranteed allocation before the draw

Timelines and draw schedules can be modified by the authority

Any claim suggesting a “confirmed plot” before allotment should be viewed cautiously.

3) Development & Possession Are the Biggest Variables

In earlier YEIDA schemes (for example, Sector 24A residential plots), brochures have explicitly stated that possession is offered only after completion of development, which can extend to five years or more.

This does not automatically apply to the new 973-plot scheme—but it reinforces one key lesson:

Possession is clause-driven, not assumption-driven.

Only the final brochure can clarify this.

Why This Scheme Matters Beyond YEIDA

Demand Spillover from NCR Markets

Although the plots fall under YEIDA, buyer interest often comes from:

Noida professionals priced out of mature sectors

Greater Noida & GN West buyers exploring plotted formats

Ghaziabad buyers tracking airport-led growth narratives

That said, current livability and commute friction still matter. Airport-centric planning is long-term by design. Today’s infrastructure experience and tomorrow’s promise are not the same.

Market Reality Check: Pricing, Liquidity & Risk

What can be stated with confidence:

Any “average price” circulating today is not final

Plot pricing typically varies by sector, plot size, PLC, and scheme terms

Plotted markets are cyclical—liquidity can tighten quickly during slowdowns

Holding power and cash-flow comfort are non-negotiable

Sector-level execution—roads, water, power, drainage—often matters more than launch announcements.

Risks Buyers Should Not Ignore

1) UP RERA Registration Is Mandatory

Until a searchable UP RERA number is available, the scheme remains incomplete from a buyer-protection standpoint.

2) Development & Possession Delays

Past YEIDA brochures clearly link possession to development completion, which may take years.

3) Strict Payment Timelines

Earlier schemes required 100% premium payment within defined timelines, with cancellation risks for delays.

4) Reserved Category Compliance

Farmer and industrial reservations involve strict documentation and eligibility checks.

5) Airport Timeline Uncertainty

Testing, inspections, or political statements do not equal operational readiness. Treat all opening timelines as provisional until final clearances are issued.

How Buyers Should Decide: A Practical Framework

Apply Only After Verifying All of the Following:

Official YEIDA brochure PDF for the 973-plot scheme

UP RERA registration number and project page

Sector and pocket layout maps

Sector-level infrastructure updates

Exact payment schedule and penalty clauses

Possession and development conditions

Decision Filters

No brochure or RERA? Do not apply

Need possession within 2–3 years? Plotted schemes may not align

Comfortable with 5+ year holding and phased development? Then evaluate—after verification